you can find all details here for the same. It can include the purchase of high-value bonds and mutual funds, property, etc. Due to the high value of such transactions, banks and financial institutions are required to report them to tax authorities. You can find the following information:Īnnual Information Return (AIR) pertains to high-value transactions. The details for the same are reflected in this section. It also has a record of any challan payments made by you.Īn assessee may receive a tax refund for a particular assessment year.

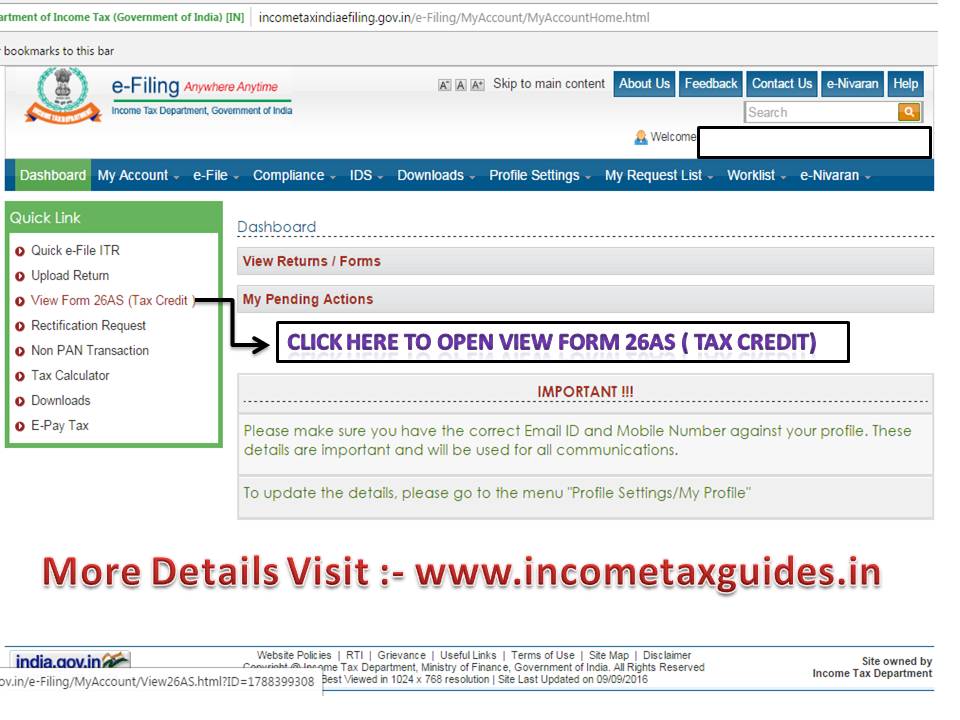

These include your self-assessment tax and advance tax. Part C: Details of tax paid (other than TDS and TCS)Īpart from TDS and TCS, you may also pay other kinds of taxes. The amount of tax collected and deposited.If you are a seller, then any tax you collect from the buyer at the time of sale will reflect here. Tax is collected at the source by the seller of certain goods. Part B: Details of tax collected at source The details of such a deduction are mentioned in this section. This means the buyer reduces the amount of tax before making the payment to you. If you sell any immovable property – land or building – during the previous year, tax is deducted at the source. Details of tax deducted on sale of immovable property (for the seller).However, it displays ‘no transactions’ if you fail to fill the forms or if they do not apply to you. If you fill out either of the forms, TDS is not deducted and the relevant details are mentioned in this section. Submission of Form 15G or Form 15H by the taxpayer prevents tax deduction at the source. Details of tax deducted at source for Form 15G/Form 15H.Tax Deduction and Collection Account Number (TAN) of your deductor.This section of Form 26AS contains details regarding the following: The TDS return is filed every quarter and is, thereafter, reflected here. The amount is deducted from your salary, interest income, rental income, and more. It complies with the given provisions of the Income Tax Act, 1961. Tax deducted at source is the amount deducted before you receive the income. Part A: Details of tax deducted at source (TDS) Let us understand each of them in detail. It serves as proof of all the tax deductions made on your income and is linked to your Permanent Account Number (PAN).įorm 26 AS has various components. Not only does it make the process easier, but it also allows you to get a tax credit. It is crucial to have Form 26AS while filing your tax return.

0 kommentar(er)

0 kommentar(er)